Current Economics and Insurance

Understand the why to plan more effectively.

By: Wade Villanueva

Grand Treasurer

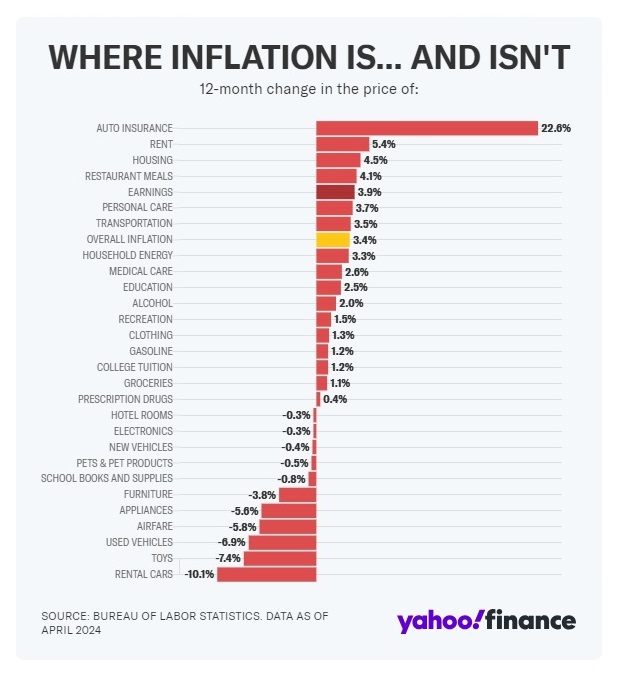

I found this surprising, although I guess I shouldn’t – since it is consistent with my own personal experience. In this time of concern about rising inflation, what do you think has increased in cost more than anything else during the past year? It’s automobile insurance! As of April 2024, it’s gone up 22.6% on average over the past 12 months. According to insurance companies, this is because of higher overall auto prices and repair costs. For me personally, I’ve also been told that it’s gone up more for cars like my Hyundai which are alas apparently easier to steal.

In addition, according to my insurance agent, it’s higher in New Mexico than other states due to the high percentage of uninsured drivers on the road and lax penalties for drivers caught without insurance. So I decided to do a Google search for more details, which led me to this website from bankrate.com which reports as of June 2024: “New Mexico drivers pay around 4 percent less for their full coverage car insurance per year than the national average. New Mexico has a comparatively low cost of living compared to many states and low population density, which could both contribute to the lower-than-average cost of car insurance in the state.” The average premium for a full coverage policy is $2,311 per year nationally and $2,225 per year in New Mexico.

https://www.bankrate.com/insurance/car/states/

Go figure! Anyway, I thought these statistics are interesting and I thought I’d share with my Brethren.